NEW REPORTING OBLIGATIONS UNDER THE CORPORATE TRANSPARENCY ACT

Download PDF To: Clients of Rossway Swan From: Rossway Swan Re: Important Information Regarding the Corporate Transparency Act and Reporting Obligations We are reaching out

Download PDF To: Clients of Rossway Swan From: Rossway Swan Re: Important Information Regarding the Corporate Transparency Act and Reporting Obligations We are reaching out

Going through a divorce can be a challenging and emotional time. Our family law attorneys at Rossway Swan understand the complexities of divorce and are

Estate planning is an essential step in protecting your assets and ensuring that your wishes are carried out after you pass away. It involves creating

Real estate transactions can be complex, and it’s important to have a basic understanding of the legal process. When buying or selling a property, there

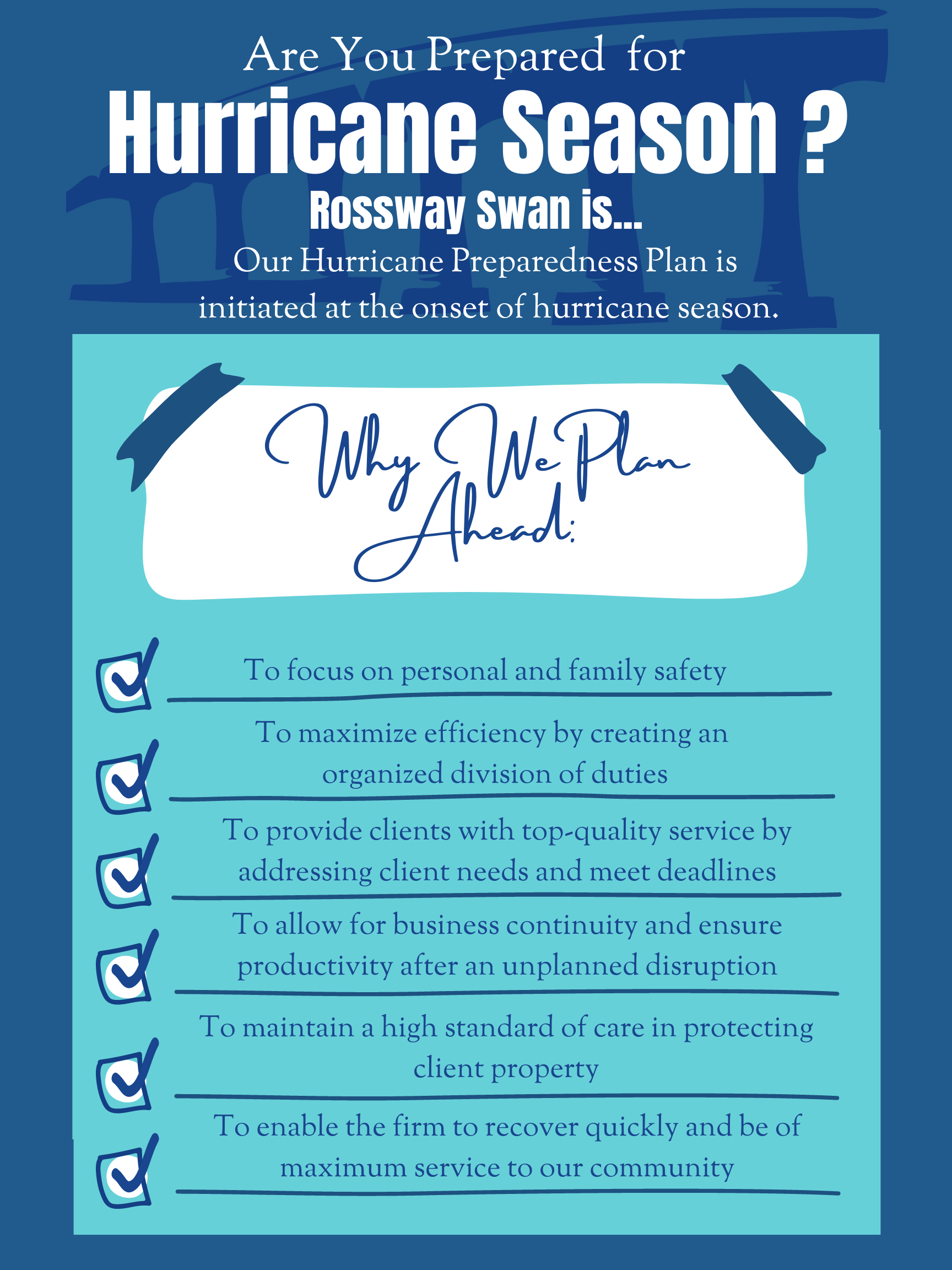

Are you prepared for the 2023 Hurricane Season? We are. Here at Rossway Swan we attended an annual procedural meeting to review our detailed and

Our firm is a proud sponsor of St. Edward’s school. It is such an honor to see the appreciation for our commitment to education in

Florida’s “Truth-in-Millage” (TRIM) Act was designed to inform property owners which governmental entity is responsible for the taxes levied against their property and the amount

Florida’s “Truth-in-Millage” (TRIM) Act was designed to inform property owners which governmental entity is responsible for the taxes levied against their property and the amount

By working together, our community, our nation, and our world will make it through the COVID-19 pandemic. However, the devastation caused by the Coronavirus has forced

The Modern One Building

2101 Indian River Boulevard Suite 200

Vero Beach, Florida 32960

Telephone: 772-231-4440

Facsimile: 772-231-4430

One Harbor Place

1901 South Harbor City Blvd. Suite 500

Melbourne, FL 32901

Telephone: 321-984-2700

Facsimile: 321-723-4092

Gables International Plaza

2655 LeJeune Road Penthouse 1-C

Coral Gables, FL 33134

Telephone: 305-443-5020

Facsimile: 305-447-0405

Rossway Swan is committed to making its website usable by all people by meeting or exceeding the requirements of the Web Content Accessibility Guidelines 2.0 Level AA (WCAG 2.0 AA). Please be aware that our efforts are ongoing as we incorporate the relevant improvements to meet WCAG 2.0 AA guidelines over time. If you have specific questions or concerns about the accessibility of this site or need assistance in using the processes found within this site, please contact us at (727) 522-8841 ext 101. If you do encounter an accessibility issue, please be sure to specify the page and we will make all reasonable efforts to make that page accessible. For further inquiries please email thefirm@rosswayswan.com.

NOTICE

Although we would like to hear from you, we cannot represent you until we know that doing so will not create a conflict of interest. Also, we cannot treat unsolicited information as confidential. Accordingly, please do not send us any information about any matter that may involve you until you receive a written statement from us that we represent you (an ‘engagement letter’).

By clicking the ‘ACCEPT’ button, you agree that we may review any information you transmit to us. You recognize that our review of your information, even if you submitted it in a good-faith effort to retain us, and, further, even if you consider it confidential, does not preclude us from representing another client directly adverse to you, even in a matter where that information could and will be used against you. Please click the ‘ACCEPT’ button if you understand and accept the foregoing statement and wish to proceed.